Ethereum's Proof Of Stake - A Conspiracy Theory

Recently, Ethereum went through a major transformation. A ‘merge’ as they call it into a new consensus protocol called Proof Of Stake, which fundamentally changes the nature of Ethereum.

Over the past few weeks, Ethereum went through a major transformation. A ‘merge’ as they call it into a new consensus protocol called Proof Of Stake, which fundamentally changes the nature of Ethereum.

This change has been a long time coming, in fact, it has been planned since Ethereum’s very inception well over 7 years ago. However, it wasn’t until now that they had the confidence to pull the trigger so to speak, and leave Satoshi Nakamoto’s Proof Of Work, to venture into their own way of reaching settlement and consensus.

While Proof Of Stake algorithms (POS) are not new per se, Ethereum’s implementation marks the largest transition of consensus protocol of any cryptocurrency, changing the foundation on which billions of dollars of wealth stand, alongside thousands of developers, and hundreds of companies.

Indeed Ethereum has grown into a large enough financial platform that it can not be ignored, nor waved away, be it by the powers that be - who in my opinion have been its stewards - nor by Bitcoin believers, to whom I believe Ethereum poses a meaningful threat.

In fact, in this installation of the WTF Newsletter, I’m going to present my conspiracy theory about Ethereum, as not only a platform for future CBDCs launched and controlled by state & banking & corporate elites. But also as a political, market, and propaganda attack on Bitcoin, through the use of the globalist bureaucratic structure of Environmental & Social Governance or ESG.

Capitalism at its best is money without enshrined political power.

The state is a monopoly over the use of violence in a geographic area.

Oligarchy is direct control of the state by those with the most money.

Proof Of Stake is direct control over the consensus laws of a blockchain, based on money held.

Thus, Proof Of Stake is Oligarchy.

Here's a quick table of contents:

WTF Is Proof Of Work?

Why Is Proof Of Work Good?

WTF is Proof Of Stake?

POW VS POS

Satoshi Nakamoto VS Vitalik Buterin

Compounding Interest Stake & Oligarchy

The Environment

Hedging Your Bets - Final Thoughts

Now, before we can get into Ethereum and Proof Of Stake, we need to define what Proof Of Work is, as it is in its comparison that this debate and contest will be had for the foreseeable future.

WTF Is Proof Of Work?

Proof Of Work is the protocol that was invented to secure the Bitcoin blockchain. It is the part of Bitcoin that miners are primarily focused on. Proof Of Work (POW) like many things in life is a game, a great contest, a challenge.

In this contest, miners try to randomly find a number they can run through a cryptographic equation, the result of which has to match a target defined by the Bitcoin blockchain.

Kind of like throwing a pair of dice in order to get snake eyes.

This game’s natural economic incentives lead to a kind of technological race, where miners try to get faster and faster computers in order to guess the winning ticket before their competitors do.

The POW game can also be joined by anyone, from anywhere, at any time. It is egalitarian in this sense, even if your odds of success are low. You don’t have to be a bank, you don’t even have to have any Bitcoin. Fundamentally Proof Of Work is open to all.

You could even try to play this game with pen and paper and try your luck.

If you get lucky and ‘hit snake eyes’ you earn some bitcoin! You can then grab all bitcoin transactions that have been broadcast recently, validate that they have integrity in relation to the balances of the accounts they come from, and add them to the blockchain, claiming their transaction fees. Once this is done, miners seal the block and broadcast it to the network, earning their reward and restarting the mining game.

At first, miners could win 50 BTC every time they won. As time has gone on, the protocol was designed to lower this amount, cutting the reward in half every four years. This is what is known among bitcoiners as the halvening. This rule about mining rewards was decided before the project was launched by Satoshi Nakamoto, and has happened automatically since the genesis block. It is as set in stone as anything can be in the blockchain world.

As I’m sure you have heard. This POW game can be very energy intensive. This is because miners have taken it very seriously, and of course, they do, the reward per block even today is equivalent to over 120 Thousand USD for what could be as little as 10 minutes of work!

As a result, the mining industry has grown and become very competitive, with chip manufacturers developing computers called ASICS designed only and specifically to play this game. Hundreds of these computers can be found in farms across the world, submerged in weird goo that keeps them from overheating as they guess over and over the magic number.

Throwing those bitcoin dice, trying to get snake eyes.

The more efficient players get at POW, the harder the game gets, essentially adding more dice per roll. If enough miners stop playing the game, bitcoin makes the game easier, removing the appropriate amount of dice. This is known as the difficulty adjustment algorithm of Bitcoin, one of its most fascinating features.

If anyone wants to revert transactions made on Bitcoin, block other people’s transactions from going through, or try to force a change of consensus rules, they have to consistently win more times at this cryptographic dice game than all other honest Bitcoin miners combined. Not only do they have to win once, but multiple times in a row, as they are essentially trying to change history in a way that is incompatible with the Bitcoin consensus rules.

It is from this computing race that Bitcoin gains its censorship resistance and security. A defense that has so far held for over 13 years.

But why go through all that work??

Why Is Proof Of Work Good?

This is the fundamental question isn’t it? As you might imagine, the answer is both simple and complex.

In a few words, POW allows for Bitcoin which is first of all money, to stand tall thanks to a game of skill. And games of skill are good, because all other alternatives corrupt society.

What are the other alternatives?

Well, you could have one unelected centralized authority decide what money is, how much of it there is, and who gets to get free money if at all. We already have that, it is called the FED. A hierarchical, politically enabled monetary system. The FED has a legal monopoly to control interest rates across banks, while in general governments have a legal monopoly to create new money. If you and I do it, we go to jail, but for them, it is business as usual.

This is what the left likes to call capitalism. I call it crapitalism. Because how can you claim to have a free market when the government has such profound control over the money supply? The money the world uses to trade and value almost everything?

Another option of course is to let banks and corporations control the money supply. The difference between the FED doing it or some bank or corporation is hardly relevant. At the end of the day it is a handful of people with control of a fundamental resource of society, one which millions of people use to store their life’s work, save for a rainy day or invest in their children’s future.

Bitcoin changes the game. With Bitcoin, no one has such power, all money is equal, all players are equal.

And we need money if we like civilization. Without money, we would be hunter-gatherers, with a population hardly larger than that of chimps. If you like comfort, safety, and the joys of art and the human experiment and modern infrastructure, then money unfortunately is an essential tool.

However, how money is created and transferred becomes a power vacuum.

Those who are closer to the source of money get to drink first, getting fatter and leaving us the scraps.

This is often referred to as the Cantillon effect, also similar to nepotism, where the powerful give favor to their friends and family, and you and I are left in the dust, taking on the risk and cost of their decisions over time.

They get to invest with the fruit of our labor as we all use the same money, but they get to create it instead of earn it. A system that is fundamentally unjust, separating human beings into two kinds, those who can legally and morally create money, and those who can not. Guess which ones rule the world?

Bitcoin and proof of work is a roundabout way to fill and destroy once and for all this power vacuum, this ring of power. And even if it succeeds it will take time.

By turning the issuance and transfer of money into a game of skill that can be played from anywhere, by anyone in the world, it is no longer just the powerful and the wealthy who can create new money or decide who gets to make transactions by edict.

The supply of money gets capped at 21 million coins. And transactions get settled by a constant and fluid game of miners from all over the world competing for transaction fees and block rewards. Allowing you the freedom to send value from anywhere in the world, to anyone in the world, for relatively cheap.

Proof of work is fair and just, fundamentally anyone can play, and we all play by the same rules.

But Juan, Bitcoin transactions are very energy expensive when you consider the respective energy cost of miners! How can that be worth it? What about the environment???

Are they expensive though? How valuable is it to society that money not be the play toy of political factions or be distributed to consolidate monopolies?

What is the price of freedom? :)

Bitcoin is backed by energy bringing security to the network in this game of Proof Of Work. What is fiat backed by?

Have you studied the history of fiat currencies? How many nations have been invaded, who tried to challenge the US Dollar? How many bombs detonated, lives extinguished and oil fields burned?

If the world really is capitalist, how much of that brutal machine of military might do you think exists simply to defend its money and the almighty golden crown of the FED?

You might benefit from the privilege of the US financial system, what about the victims of Venezuelan communism, or Iranian Islamic dictatorship? They, cut off from the US financial system through sanctions are total slaves to the boot of their local state. Except for Bitcoin which for years has been providing them an escape hatch.

A mini-documentary by yours truly.

Better yet, how valuable is it that the FED and its surrounding political establishment can not simply print money and take over Bitcoin mining? The FED can print neither computers nor energy after all.

They would have to buy uncountable amounts of ASIC computers, which don’t necessarily exist yet. They would then have to find talent to manage these computers without destroying them, acquiring human talent and good judgment which is harder to find than you might imagine.

Finally, the FED would have to source the electricity, enough of it to play the game and dominate all other miners, then they could regain their golden crown with Bitcoin.

(And then we would fork Bitcoin and fork over the FED lol.)

Of course, they’d have to sustain that power over time, while competing with Russia and China and every other nation with miners out there, also playing this great game. A game designed to maintain fairness and justice in money. A game that resists censorship, nepotism and oligarchy.

Or they could just print a bunch of fiat and buy up Ethereum.

WTF is Proof Of Stake?

Unlike POW which spends energy and computing cycles to throw those dice and try to get snake eyes, Proof Of Stake (POS) considers one ETH, one vote. Stakers as they are called have to lock up whatever ETH they stake for the foreseeable future until the next upgrade™. In return they get to throw those dice and try their luck at an otherwise similar game.

If you are solo staking, you’ll need 32 ETH minimum to unlock a ‘validator node’, this lets you participate in the block production process and make choices about what transactions get mined. Similar to solo mining, the odds of winning the round are lower, but the reward is higher.

When you stake your ETH with a staking pool, you are joining forces with other ETH stakers, and handing over your ETH either to a smart contract or a third party, who should lock up your ETH in a validator node, reaching the minimum of 32 ETH.

This ETH is also locked up as per the nature of Ethereum’s current staking protocol. A staking pool might give you a ‘Liquidity token’ which you can go and trade in DeFI markets, but your ETH will not be directly redeemable until the next upgrade™.

POW VS POS

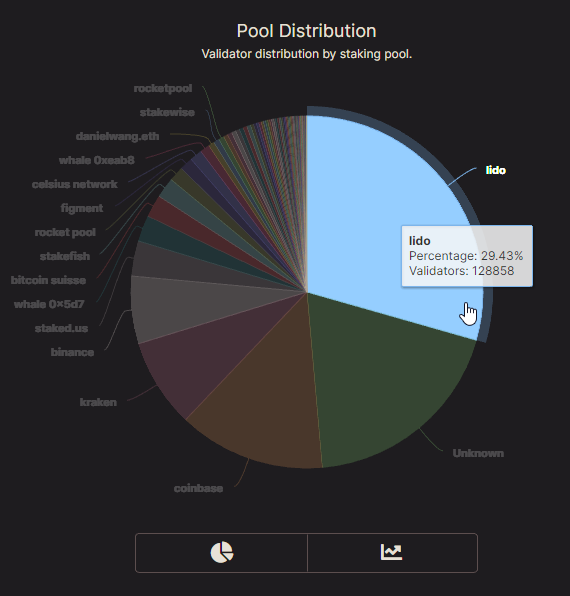

The inability to withdraw your staking consent from a particular Ethereum validator is actually very important. You’ll often hear that Bitcoin is centralized because of mining pools. You’ll see charts like these, which show you coalitions of miners trying to maximize their returns.

What those critics often don’t clarify is that not all of these are solo miners, the majority of them are pools of miners of various sizes. Foundry USA for example is one such pool that offers a variety of services to various miners who in general control their own hardware.

Unlike Ethereum Stakers, POW miners can remove consent and support for any mining pool at any time. If a mining pool gets too big, or there are reasonable concerns of collusion (as has happened before during the BCH fork wars), then solo miners quickly remove consent and mining power from the relevant pools, and grow their competitors.

With Bitcoin’s POW there’s also an aspect of geopolitics. Foundry USA is in the United States, obviously while F2Pool and AntPool are based out of China. This geographic and jurisdictional decentralization is significant and can mitigate the possibility of collusion or state interference.

Currently with Ethereum’s POS, if staking pools colluded, there’d be nothing you could do to remove your consent from these pools, other than selling your ‘Liquidity token’ at a loss.

You’ll also notice the third biggest staking pool in Ethereum as of the time of writing is Coinbase. Coinbase of course is staking with user funds, likely with their consent. Nevertheless, it is Coinbase that now has the decision-making power about what transactions go into those blocks, and which blocks get integrated into the blockchain.

When it comes to Bitcoin, Coinbase may have a significant portion of BTC in custody for their clients, but they can not affect the fundamental consensus decisions, they have no Proof Of Work.

This is a fundamental difference and one I believe makes POW a superior protocol.

Proof Of Work creates a separation of powers. The wealthy, the banks, the exchanges, the whales in Bitcoin don’t have direct influence over the consensus protocol. They Can Not Change The Rules. Ethereum whales, banks and exchanges can.

Satoshi Nakamoto VS Vitalik Buterin

Even if Satoshi Nakamoto himself came back from the dead or whatever private island he’s been chilling at for the past decade, and decided to throw his weight around. He would have the same problem anyone else has influencing Bitcoin’s fundamental protocol. Even with his alleged million BTC wallet, he’d have to compete in the mining game, get on the queue for mining hardware and find enough electricity to power them. He’d have to hire talent, likely incorporate his mining operation which carries a serious risk of revealing his identity, and finally try and push his weight around.

All of that to gain the power to censor transactions and reject his enemy's blocks. The worst he could do would be to try and change consensus rules but if history is any guide he would be met with fierce opposition, as demonstrated with the BCH fork wars. Not even Bitcoin Jesus - Roger Ver, a prolific seed investor in the early days of Bitcoin, responsible for the likes of Blockchain.com could survive such ambition.

Vitalik Buterin on the other hand. How much ETH does he own?

Well, thanks to the wonders of Ethereum’s absurdly transparent blockchain, we can know this with decent accuracy, (if you think Bitcoin has privacy problems, wait til I tell you about Ethereum). According to some analysis including Vitalik doxxing his own address during a Shiba Inu incident last year, Vitalik holds around 330 Thousand ETH.

There’s a total of 14.8 million ETH staked right now, about 12% of the total supply. Assuming Vitalik staked all this ETH, he would control around 2.2% of all of ETH’s staking power today. Not a large amount all things considered, but not insignificant either. Of course, Vitalik’s influence is much greater than how much ETH he actually controls.

This brings us to another aspect of Ethereum’s centralization forces. With Satoshi Nakamoto gone, Bitcoin has had to navigate its own fate for well over a decade. Many political games have played out in Bitcoin and so far have arguably failed (though you may be in the minority that disagrees). With Ethereum they are only getting started. And unlike Satoshi, Vitalik is not anonymous. We know who he is, we know he is Russian - Canadian, we know he is a nerd.

Can he leave his role as soft power emperor of Ethereum? Even if he wanted to? Will he not be called upon if a consensus crisis occurs? Will he not be compelled to answer? Do you really believe he’ll resist the temptations to put his weight on the scale?

Worse yet, how do you know that Vitalik is not compromised? He may be a math wizard, I think we can give him that. But does he have the political cunning to avoid falling for some blackmail trap? I personally have an anecdotal experience which I can provide no evidence for that nevertheless has convinced me Vitalik is profoundly compromised. He is not a bad dude, but I believe someone has blackmail on him that would destroy his name forever.

The reality is, Vitalik is a huge target, with grand influence. Whatever direction he errs in, will carry great weight, and he probably can not escape it. Especially if someone has leverage over him.

How much influence does he have over the Ethereum Foundation? And how much stake do they have? Looks like the answer is 341k ETH. That’s 2.3% of all ETH staked, although most of it is likely not staked today, it could be on a crunch.

How about Consensys? How much ETH do they control? Or its founder and ETH ICO investor Joseph Lubin? These numbers surprisingly were not easy to find. While there is speculation about what they are, I could not find an ETH address, suggesting they are held in custody, likely at Coinbase or another such exchange.

Compounding Interest Stake & Oligarchy

How do the laws of compounding interest not apply to POS staking?

If you control a majority of ETH beig staked, and someone does. Someone out there has one ETH address that has more ETH being staked than anyone else, even if it's in the single digits. How fast will their average rewards stack relative to the rest of stakers?

If they controlled say 10% of ETH staked, and earn 5% as staking reward per year. How fast will they be able to gain 51% of ETH staked?

All else being equal of course, according to this compounding interest rate calculator, it would take about 33 years. In 33 years they would have enough ETH to dominate all other stakers today. Granted, this assumes a staker does nothing but reinvest their rewards. It also assumes that the share of ETH stake does not grow beyond 12%, but for the patient and long minded this game could lead to multi-generational wealth.

That biggest single share of ETH is fixed, if it is 2 million ETH, it can remain as such and only grow, one reward at a time. Every unit of ETH is not just a unit of account now, but a unit of power in the Ethereum blockchain. Their power in Ethereum as such is entrenched. There’s nothing anyone can do about that, short of hacking the owner, or somehow coercing them to sell, if they are not willing.

There is no space to compete with an ETH whale, no ability for the young to replace the old. No capacity for the competent to rise above the incompetent who will age out of touch with the average human experience. You could be born into this fortune and milk it for the rest of time. Eventually, it would take over enough total ETH to control Ethereum’s consensus protocol directly on a whim. Even if everyone else was also reinvesting all their staking rewards.

On a long enough time frame he who has the most ETH wins.

If the consensus protocol of a blockchain is akin to the constitution and laws of a country, then one party controlling the consensus directly with how much money they have is nothing short of an oligarchy.

Capitalism at its best is money without enshrined political power.

The state is a monopoly over the use of violence in a geographic area.

Oligarchy is direct control of the state by those with the most money.

Proof Of Stake is direct control over the consensus laws of a blockchain, based on money held.

Thus, Proof Of Stake is Oligarchy.

The Environment

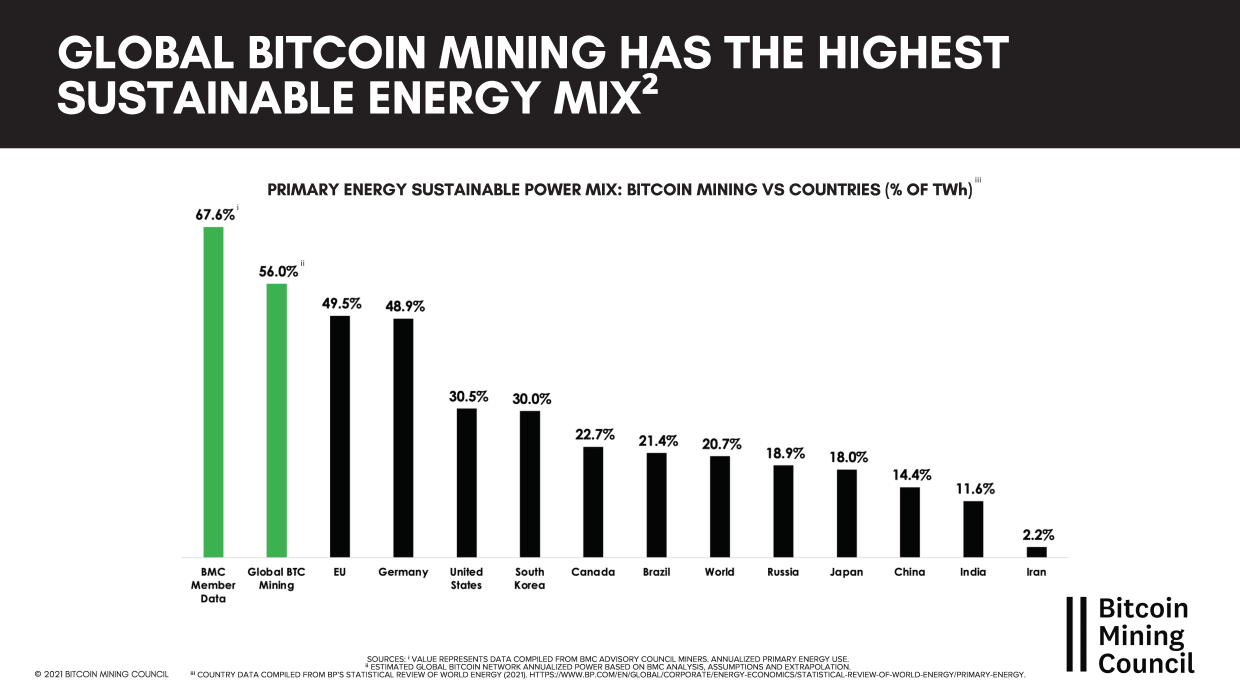

As you know, I’m not a believer in man-made global warming, as I’ve seen enough bullshit from these types come and go over my lifetime and in recent history. But at the end of the day it is a decision and judgment call you have to make, and invest your time and coin accordingly.

Speaking of oligarchy, let’s talk about ESG. This bureaucratic globalist superstructure that tries to price the costs of CO2 emissions of industry by edict, is the blood and nervous system of the international government being erected.

This structure is not based on market pricing, but on a manipulable laundry list of checkboxes and the judgment of rating agencies that can make any argument they wish.

The weather after all has as many variables as anything possibly could have.

So while the intentions of the environmentalists might be pure, the machine they are defending is controlled by a small unelected elite. And it is being used as a political weapon, aimed at the very foundations of our civilization.

The WEF, the biggest cheerleader of the end-of-the-world environmentalist narrative, is the most visible head of this international hydra. And just as they have used the ‘end of the world’ climate change narrative to bash the gas industry into submission, making Germany for example dependent on foreign energy, so are they planting the seeds now to do the same against Bitcoin mining.

Funny how quiet they are, now that the Russian pipelines got mysteriously blown up, releasing uncountable amounts of gas into the atmosphere and ending the immediate possibility of peace with Russia. But that’s a story for another time.

The lines on the sand have long ago been drawn and the line of attack is clear. Bitcoin, no matter how renewable its sources of energy might be compared to other industries, will be attacked and smeared consistently as a waste of energy that can only destroy the environment.

This is repeated mindlessly by ‘journalists’ daily and twats proclaim it self-evident without the slightest consideration to the value Bitcoin provides them and the world, or the evidence for that matter. Or the realities of Bitcoin’s energy use.

Ethereum’s elite knows this, they’ve known it from day one. This environmental FUD after all has been plaguing Bitcoin for well over a decade. Even Hal Finney was concerned with Bitcoin’s potential CO2 footprint, which goes to show how deeply rooted this narrative is, in our era.

And thus, Ethereum is aligning itself with the World Economic Forum, alongside the corporate and anti-national elite who brought us greatest hits such as the Covid lockdowns, and every farmer revolt in recent memory.

It is thanks to them after all that Europe is seeing giant leaps in gas prices, as their efforts to destroy the energy industries of Europe have been quite effective, while ‘sustainable energy’ sources barely scratch the surface of the energy needed to maintain our civilization.

Last but not least, JP Morgan is being reported to have basically purchased a major stake in Metamask -the biggest Ethereum wallet - and Infura the biggest Ethereum archival node from Consensys, in exchange for 39 Million USD back in the summer of 2020. This gives JP Morgan, another great head of the hydra, a powerful position in the Ethereum ecosystem.

Add to that the knocking down a peg of Tornado Cash - the privacy mixing service smart contract - by OFAC a few weeks ago who put the smart contract address on the US government’s biggest shit list, and we have a very clear setup for where Ethereum is going.

Major staking pools are already blocking Tornado Cash transactions in compliance with OFAC, what other laws are they willing to enforce in the future at a consensus level?

A similar tactic was tried against Bitcoin, with a mining pool becoming explicitly OFAC compliant, this stunt lasted days and was mocked out of existence.

At the end of the day, the FED and other banking interests can not print energy or ASICs, they can only print money, that is the source of their power. Leaving Ethereum as a much easier target. After all, what is the ability to print money at will - a kind of counterfeiting - but the fundamental problem that cryptocurrencies are trying to solve? The fundamental power they challenge?

Making yourself more vulnerable to the printing press is to surrender to ‘the powers that be’, rather than take a stance against them.

As such I believe Ethereum is set to become a market, propaganda and regulatory-based attack on Bitcoin. Its Proof Of Stake consensus will be used as an example of why Bitcoin is so ‘wasteful’ and this argument will be brought to every relevant politician and regulator.

WEF types might even see their ability to control Ethereum’s consensus layer via soft and hard economic power as a fertile ground on which to grow their CBDC monstrosities. Central Bank Digital Currencies, the final form of the fiat system, a digital currency with Chinese-style surveillance powers and controls.

Bitcoin in turn will continue to be pushed to the fringes. Adopted as a sign of rebellion against the technocracy. How the dust settles will only be known in time.

Hedging Your Bets - Final Thoughts

The choice is simple. A bet on Bitcoin is a bet on a game of skill that is resistant to censorship and oligarchy.

A bet on Ethereum is a bet on the globalist, international government superstructure being erected by the likes of the WEF.

I don’t know if I made a compelling enough case for that reality in this article, but that much is clear to me.

Not long from now, Ethereum people will realize this and a fork war will be waged, if we are lucky. This new consensus game will be tested, and someone will come up on top.

My political and moral preference is clear, I want Bitcoin to win. I see little come out of Ethereum other than ponzi schemes by other names. Ponzi schemes fleece the financially illiterate retail buyers, and concentrate gains on the hands of the shrewd and the cunning.

If it doesn’t have a product, does not offer a useful service, or does not build needed infrastructure, then it is a ponzi scheme.

But as a betting man, even despite 4000 words on the issues with Ethereum, I have to recognize that it makes sense to hold some ETH. I just want you to understand what you are betting on.

The fact that Ethereum is aligned with the oligarchs and global elite is hardly bearish.

We are in for a wild ride.

All the best.

Juan Galt.