How To Buy & Hold Bitcoin - 2021 Edition (It’s Not Too Late)

If you are reading this, chances are you are considering a ride on the Bitcoin rocket. And how could you not? It has been around for over 10 years now and it keeps going up and up!

First published on • Jan 2, 2021

Also, you are probably looking for ways to increase your income online and Bitcoin might be just that boost, to your financial freedom.

Prodigy Bitcoin entrepreneur Jack Mallers put it best when he explained why NFL player Russell Okung decided to start getting paid half his income in Bitcoin. In an interview with Fox Business:

Finally you might be aware of the long term consequences of the Covid-19 bailouts, and the 30% increase in US Dollar monetary supply just in 2020.

Where does all this money come from?

Doesn’t printing all that money have consequences?

If the government can just print money, why do we pay taxes?

Are these bailouts going to lead to inflation? Are things gonna get more expensive?

These are some of the questions people all over the world are asking themselves right now.

Simply put, the short answer is, yes.

For decades, many have been concerned and warning about an event like Covid 19, destabilizing society and crashing the overleveraged and indebted economies of the modern world.

But now, it looks like it is actually happening. And many are looking for a way to protect their wealth.

Bitcoin is a life boat to survive these confusing times.

Bitcoin is a life boat to survive the tsunami of fiat currency that central banks all over the world are imposing on humanity.

When all you have is a hammer, everything looks like a nail. The modern monopoly over printing money enjoyed by central banks begun with the world wars of the past century. It has now gone full circle threatening the stability of global markets. It is used as a weapon of economic subversion to manipulate the value of imported and exported goods. While it's rails are tools of political censorship in a climate of exuberant cancel culture.

All this easy money also flows first to those closest to power. Preventing the immune system of the market to function, the boom and bust cycles. Incompetence becomes established while start-ups are bought out by corporate giants and integrated into the corporate political borg.

Meanwhile, as they lock down the world for a year long "quarantine" (crushing small businesses). US Congress struggles to pass a financial relief bill to deliver $600 Dollars to those same Americans, while quietly attempting to move hundreds of millions to entirely unrelated causes all over the world. I'm sure you are aware of this scandal as well.

Bitcoin's whole infrastructure was designed to destroy this hammer by giving you a way to opt out.

This hammer is a currency by edict that no longer serves us. Bitcoin provides you an option by limiting the amount of currency units can exist within it's system to 21 million bitcoins and building the most impressive technological infrastructure around it, to protect this simple rule.

There's something rotten in the state of Denmark

The fact that you are reading this puts you ahead of many, probably most people out there.

If you play this right, you might actually thrive during this great storm of paper money and political decadence. You could be positioned to help your family, friends or your community come out on top as we exit those turbulent waters and strong winds into a calm sea and a clear sky.

So, how do I get Bitcoin?

Well, if you are an American. The best service I can recommend is Swan Bitcoin.

This is a financial service that lets you automatically buy a specified amount of Bitcoin on a regular bases, so that you can accumulate a position in the most effective way Bitcoiners now how, Dollar Cost Averaging.

If you are new to the concept of Dollar Cost Averaging or DCA, then let me tell you, this strategy for buying Bitcoin is amazing. Most professional traders fail to beat the returns that this accumulation strategy offers, and it could not be easier with a service like Swan Bitcoin.

Basically, instead of maybe, buying the top of a short term rally and having to wait longer than usual to see returns on your investment - as happens in all real investments, not just Bitcoin.

You build a position over time, regardless of the price. Resulting in an average purchase price over time. Check out this awesome DCA calculator and play with the settings!

Dollar Cost Averaging with a service like Swan Bitcoin protects you from Bitcoin’s volatility while also minimizing the amount of effort you need to buy it. Making sure you don’t get distracted or forget to put some savings in this asset class, as many do and regret it later.

You would not believe the amount of people that have reached out to me over the years saying:

“Omg! Bitcoin has gone up so much! I should have listened to you and bought some at $30, $150, $600 . . . $4,000, $10,000 …” and so on.

I’ve been doing this for a while, it is very easy to miss ‘the next dip in the price’ or ‘forget to buy’.

Today, to the best of my knowledge, there could be no easier on-ramp to Bitcoin for Americans than Swan Bitcoin. Just tell them how much you want to buy and over how long a period, and they’ll do the rest.

It isn't the most private way to do it, but it is the best way to start as you learn more about this industry. So you don't miss the boat.

I mean, the rocket.

What if you are Canadian?

Well the best recommendation I have for Canadians is Bull Bitcoin.

Bull Bitcoin is a Bitcoin onramp built and run by good guy Bitcoiners who contribute to Bitcoin's overall strength and open source ecosystem. They also happen to have an excellent service with some of the best prices in the country while being quite easy to use.

But, Bitcoin is almost $30,000 US Dollars, isn’t it too late?

Nope. I don’t think so. I think we are just getting started.

Here’s the thing, despite the shocking price rise in Bitcoin over 2020 (not that shocking if you look at the backdrop) Bitcoin is still a tiny portion of the global market.

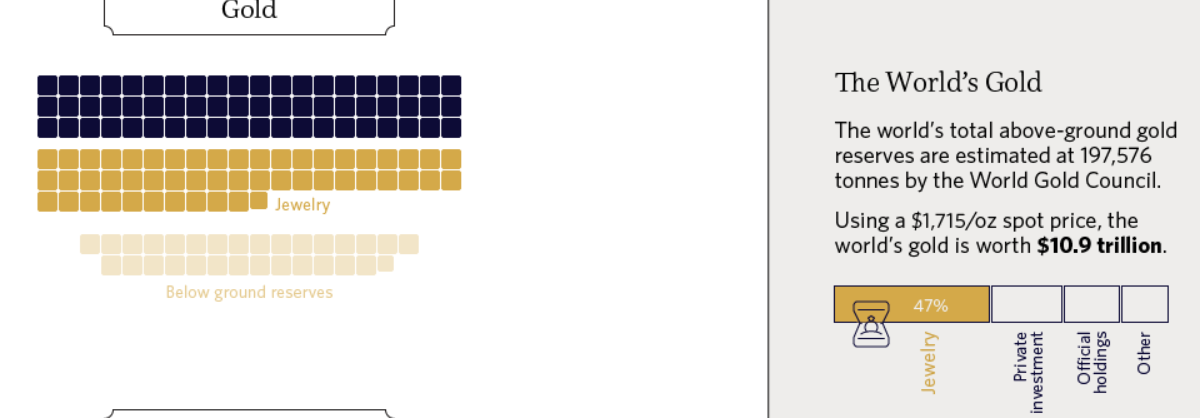

For example, did you know Gold has a market capitalization of about 10 Trillion Dollars?

Market capitalization is the number you get when you multiply the price of an asset by the amount of units on the market.

Bitcoin is about half a trillion US Dollars in market cap at price of around $30,000.

Do you know how many US Dollars are out there in the market? Be it in savings accounts or in cash?

Around 13.3 Trillion according to the above estimates.

Not a lot of this money has to go into Bitcoin for it to multiply in price.

Further more, there is a lot of corporations and institutional money, that are looking at the Dollar and other fiat currencies, with their near zero interest rates (in some cases negative??) and rising risk of inflation. They are getting worried.

Michael Saylor, Billionaire entrepreneur turned Bitcoin bull put it best, when he said that his company's cash reserves while sitting in dollars are a "melting ice cube."

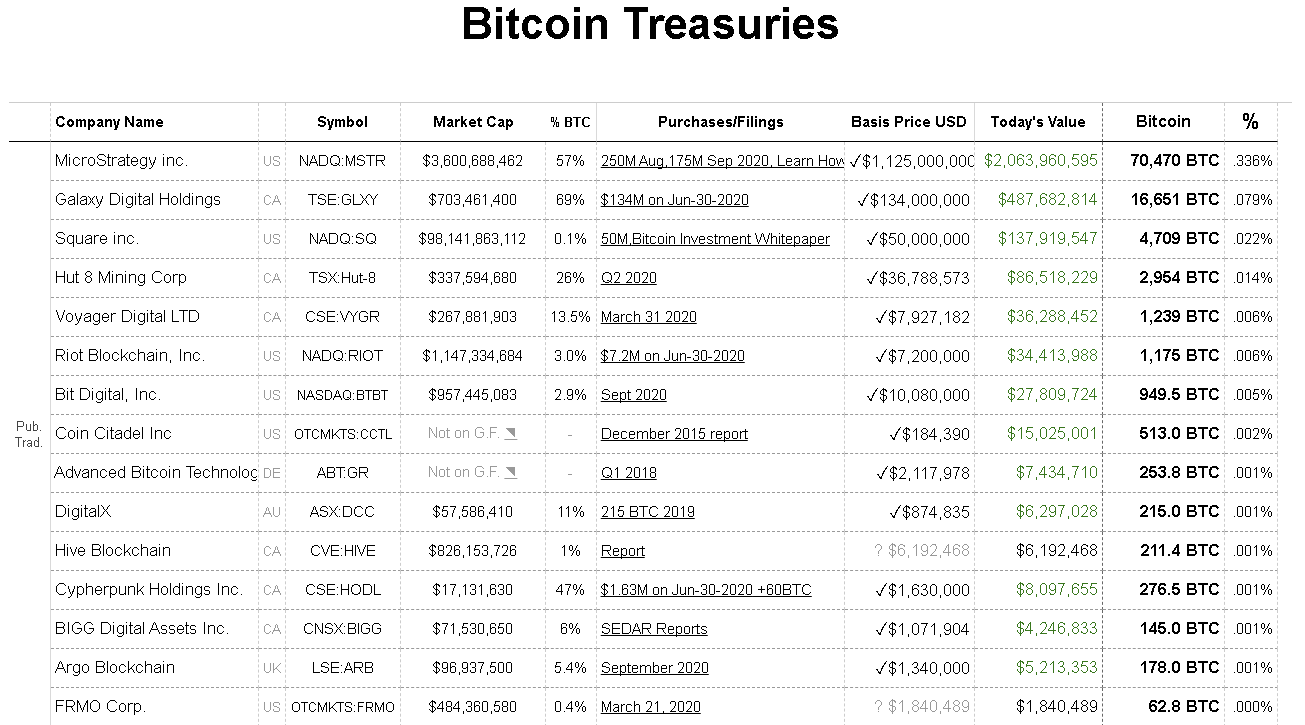

Here's some publicly traded companies that have Bitcoin in their treasury reserves.

And three funds with positive outlooks for Bitcoin from 2020

Many of these big players are turning their attention to Bitcoin as a low risk, safe haven asset.

It’s not just that the demand for Bitcoin that is rising though, bitcoins are getting harder and harder to get.

As we talked earlier there is a very hard limit on how many bitcoins can exist. Everything in the Bitcoin system is designed to keep this limit as it is. This number will never change.

This may not seem that impressive, but it is actually unlike any other asset in history. Basically anything else people want, more of it can be made. This is a key piece of market theory, innovation allows us to turn less resources into more resources through capital investment in factories, better tools, bigger machines, more refined chemical processes. This is also the case with gold, as the price of gold rises, the mining companies get switched on, pulling more gold out of the ground and selling it on the market. But it is not the case with Bitcoin. More "Bitcoin mining" equipment going online just raises the difficulty of mining instead of decreasing it.

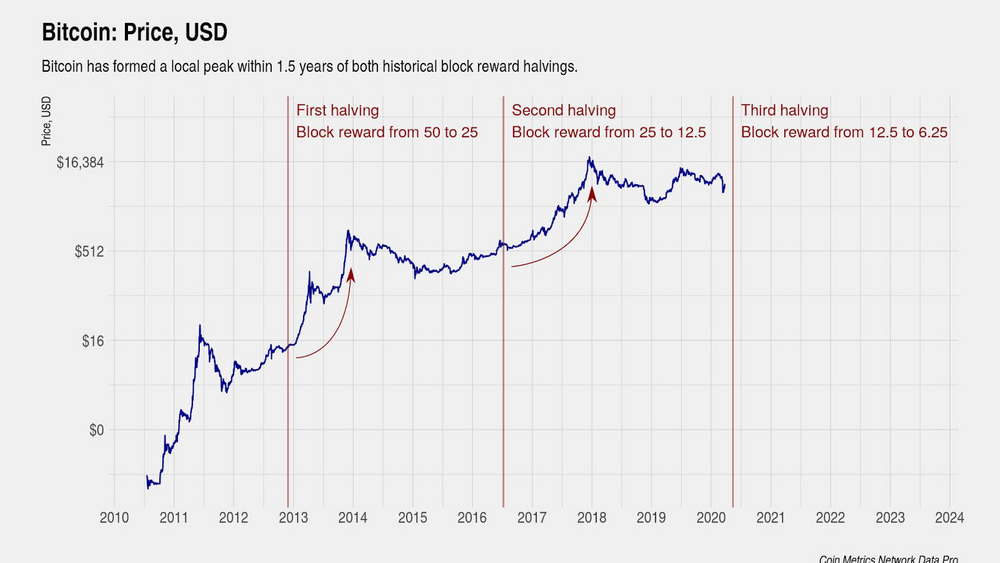

More than that, every four years, the amount of bitcoins that enter the market through the process known as bitcoin mining, gets cut in half thanks to an algorithm put in place in it’s inception. This cut in bitcoin issuance is known as the Bitcoin Halving and it is closely correlated to parabolic rises in the value of the asset.

All bitcoins are expected to be mind by around 2140. And over 18 million of the 21 million bitcoins that exist are already in circulation. Perhaps up to 4 million of them have also been lost to bad security and hodl practices (something I will teach you about further down in this article).

So, demand is rising and the supply is tightening.

How high can the Bitcoin price go?

Well, if you ask me. The sky is the limit. But, I understand that such an answer is not... satisfying. So here’s some conservative technical analysis, based on the 11 years of price history that Bitcoin has.

Long story short, from the top of every bull market to the top of the next bull market, there’s a rough average of about 26 times the value of the asset.

In other words, the last all-time-high was 20k USD. The next ATH might be over 400,000. This is actually not that crazy an estimate, parabolic moves are... hard to wrap our head around.

But let’s say this bull market gets cut in half because parabolic moves don’t last forever. And just to make it more difficult, let's say the time it takes to get there doubles. Ok we are still looking at 150,000 USD a bitcoin by 2026.

That's still 5 times more than the current price of Bitcoin at 30k USD. Far better than most investments. Probably enough to continue to set records.

As you can see below, we are way ahead of schedule.

Frankly, getting to 100,000 in the next 2 years, would be a home run investment.

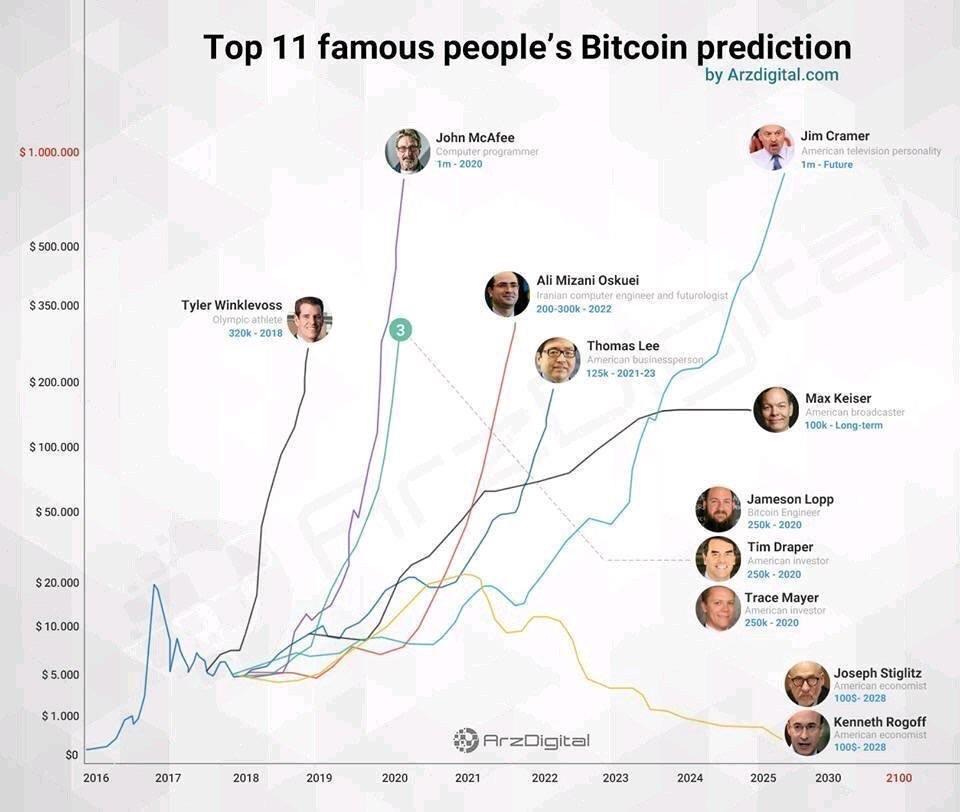

Here's some estimates that are far more bullish, by some famous investors.

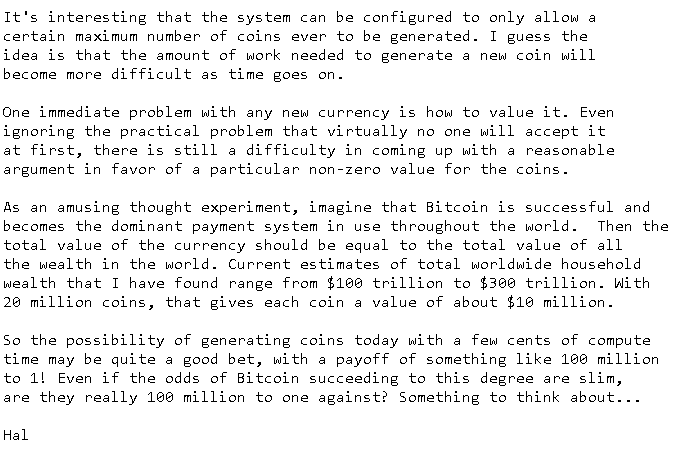

Perhaps the most bullish of all estimates was done by legendary computer scientists Hal Finney, number 2 Bitcoin contributor after Satoshi Nakamoto, placing Bitcoin as high as 10 million USD.

Last but not least I'll leave you with a very elegant logarithmic chart which gives us a very reasonable outlook for Bitcoin's expected growth in the next decade.

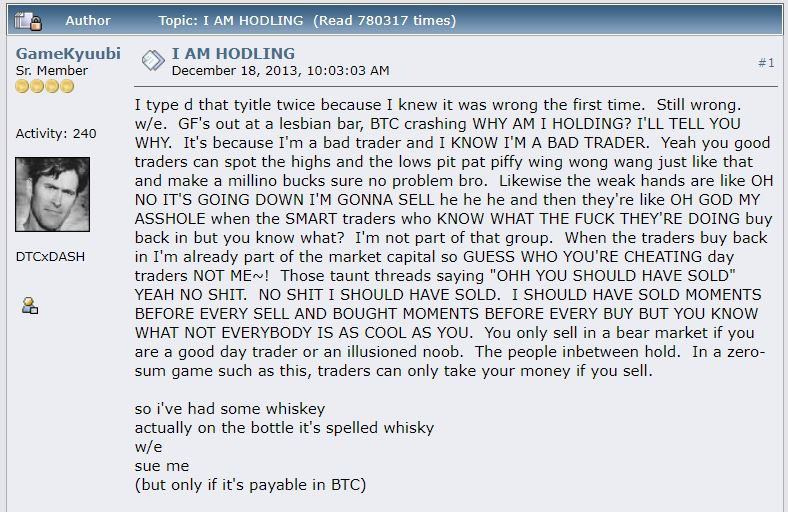

Any bet on Bitcoin now could lead to some solid gains, that is, if you manage to HODL on to this rocket long enough to get there.

The Art Of The Hodl

Remember how I mentioned that about 4 Million bitcoins are estimated to have been lost forever due to bad security practices?

This is a real thing, I myself lost 8 bitcoins I bought at 7 Dollars each back when I was a broke 20 year old. That would be about 240,000 Dollars at today’s prices.

This loss, which I am at peace with now, taught me the hard way to get serious about Bitcoin security and It is the prime reason why I’ve dedicated my career to educating new Bitcoiners on how to protect their investment.

Frankly, I knew so little at the time about trading and technology that it would have been somewhat of a miracle for me to have managed to keep hold of them. It was much harder to hodl back then, and we were blind as we explored a new, wild frontier.

Not only did you have to secure the ‘private keys’ in a ‘wallet.dat’ file. But you had to not get scammed buying into this exciting new ICO or investing in that new speculative shitcoin.

Yes, these ‘altcoins’ have been around since about year two of Bitcoin with the advent of Namecoin and then Litecoin. Since which there’s been over 10,000 altcoins created, 98% of which have been forgotten by most and over 60% of which are now dead. So dead in fact that the most famous crypto ranking website CoinMarketCap.com doesn’t even list them any more.

(For an easy laugh, have a look at the last page of coinmarketcap, the visible bottom of the shitcoin barrel)

Despite 9 years of heavy altcoin competition, no altcoin has gotten even close to matching Bitcoin’s market dominance, security, decentralization, liquidity or brand recognition.

While there may be some short term gains to be made trading the altcoins (as a professional trader, I can attest to this). I can also tell you that it is a very risky game that is best studied carefully before entering. Specifically you must learn to manage your risk properly, so you don’t take one big loss that ruins you.

99% of these altcoins have no fundamentals to speak of, they are bloatware, and will soon be forgotten. They are distractions trying to get to your Bitcoin. That is lesson #1 of the art of the hodl.

Lesson #2 of the art of the hodl. Not your Keys Not your Bitcoin.

Heard of Mt.Gox? Maybe not, This was the biggest Bitcoin exchange back in 2014. It got hacked. Millions were lost. This was one of many exchanges that went under, taking their users' bitcoins with them. Be it from external hacks or internal theft the history of custodial bitcoin exchanges is a graveyard of lost money.

While bitcoin exchanges today are much more secure, and it has been years since the last major Bitcoin heist, it is still important that you -not only- know how to store your own Bitcoins. But that you keep a majority of them off exchanges. As even if the exchanges are safe from hackers, they are probably not safe from nationalization. And let’s face it, greed and political power grabs are in vogue.

So, Not your keys, not your Bitcoin.

How do you secure your own coins?

Well the first step is to get a mobile wallet. There’s a website called WalletScrutiny.com by a nice guy Bitcoiner that looks at wallets, checks if they are open source (anyone can verify that they are honest) and ranks them accordingly.

Of the hundreds of mobile wallets out there, only a handful pass that test. Green Wallet by Blockstream is in my opinion, the best of the lot.

Once you download Green Wallet on either Android or iOS, and click the ‘create a new wallet’ button. You will be guided through the setup process.

In this process you will be given 24 words. These are the keys to the kingdom, your passport to your Bitcoin, your proof of ownership of any BTC you send to that wallet.

You see, unlike banks, who can identify you based on your face, name, nationality, and ID number, Bitcoin can not.

Bitcoin does not know – in fact – can not know, who you are, how old you are, what nationality, gender, political orientation, or race you are, and that is by design. All it can know is whether or not you have a password that corresponds to an account balance on the Bitcoin accounting ledger – also known as the blockchain.

If you have the password, you can move the bitcoins. If you do not, you can not. And that’s it. Simple, pure. Designed to make privacy possible.

These 24 words are an easy to read version of this secret password. It is 24 words because it needs to be a password so secure that not even government agencies, heck, aliens can crack it. Math and cryptography tells us that 24 words is as far as we can imagine, are more than good enough.

So make a secure copy of these words, write them down in a special notebook and store them like they are your grandma’s secret heirlooms, potentially worth millions. Stash em away like Pablo Escobar. Bury them like a happy dog with his lucky bone.

But never, ever. EVER, make a digital copy of these 24 words. Do not take a screen shot of them, do not type them on your phone’s note pad, do not put them in a password manager or a word processor.

Why? Because most computers are insecure and most people have no idea how much malware their computers carry.

These 24 words are meant to stay offline to protect you from ‘hackers’, mostly automated malware and malicious ‘altcoin’ wallets.

Also, never type this 24 words into a website or app unless:

-You have lost the device that gave you these 24 words like the phone with your Green Wallet or a hardware wallet (more on hardware wallets some other time).

-And you are sure that you are going through the official recovery process of a legitimate website and not some phishing scam as that being run on victims of hardware providers, like with the recent Ledger Hack.

If you have ever typed those 24 words into a computer and not moved your coins to a new fresh and secure wallet, then consider those words compromised and go move those coins now. Better safe then sorry.

Now, You might be thinking. Omg this is crazy, I didn’t think it would be this serious. Well here’s the good news. The day that it becomes brain dead easy to hodl Bitcoin, it will probably be too late.

Everyone will have some and they will think nothing of it. It will be our water and our oxygen. At that point the great investment opportunity that Bitcoin presents will be a thing of legend and history and you’ll be better off looking for the next frontier.

Ok so you have a Green Wallet, now what?

Well go withdraw your Bitcoin from that exchange! Be it Swan Bitcoin, Cash App (Also quite good for Americans), or BullBitcoin.

Give them that ‘bitcoin address’ that looks something like this “bc1q490kgfn596tynyu2p5cwzsjx2j4fmr6g6g8lu6uc8qc8jh9568msuw3r2g” and ask for a withdraw.

Soon the BTC will be on your wallet.

Now, unless you started big with a full bitcoin then chances are you’ll have 0.00... something worth of Bitcoin. Which leads us to a quick side bar on Sats.

Sats are short for Satoshis. Satoshi Nakamoto was the inventor of Bitcoin (Pseudonymous, fascinating and mysterious creature, MIA since 2010). Satoshis or sats are the smallest denomination of a Bitcoin, aka 0.00000001 BTC. Or 8 decimal places to the right of a full bitcoin. Whenever you get some BTC you are “Stacking Sats”.

Congrats! Once you’ve completed your first withdraw to your personal wallet you have successfully stacked sats and are now Hodling Bitcoin!

Now, I could teach you a lot more about how secure your Bitcoin, your digital wealth in general and how to navigate this very exciting and promising market.

But that will have to wait until my next article (which you should subscribe for so you don't miss it! Don't worry it is free, for now).

In the meanwhile if you need to talk to someone that will not bullshit you, feel free to set up a consulting call with me right now and I'll give you my latest thoughts on anything regarding Bitcoin and this industry in general, including how to safely store your coins and how to play the market.

Til next time and HODL on.

Juan Galt.