“Know Your Customer Laws” and Identity Theft

KYC laws are a clear violation of the US constitution and yet have been implemented across most crypto exchanges, putting users at risk of identity theft.

The following is the first installment of a series about regulation in the Bitcoin and crypto markets.

Part 1:

The Libertarian Perspective & Its Biases

“Know Your Customer Laws” and Identity Theft

Future installments include:

Bitcoin and Crypto Commodities

On Bitcoin’s “Immaculate Conception”

Ethereum and Crypto Securities

Ponzi Schemes And Financial Literacy

Actual “Crypto Currencies” and Stablecoins

Enjoy and tell your frens!

The Libertarian Perspective & Its Biases

As a lifelong libertarian, the topic of regulation is one I have a natural aversion to. My intuition is to resist it, and my preference for a long time has been to keep the state’s grubby hands off “crypto”. Sadly, as the years go by, I’ve seen such a proliferation of fraud and ridiculousness in this industry, that today I have to hesitate and re-evaluate.

From dumb ponzi schemes using the Bitcoin brand to scam retail via centralized, low-tech websites. To tens of thousands of straight scams, be they Ethereum tokens or blockchain forks whose nature intentionally or not is that of concentrating wealth in the hands of founders from later investors. With few if any products, services, or solutions to back up that value.

This article explores the topic of crypto regulation. The more relevant proposed frameworks, what I think would make sense, and what impact they might have if any at all.

As a matter of principle, I have to remind my fellow ancaps and libertarians that fraud is a violation of the non-aggression principle. And while the state has a monopoly on violence, its processes are the lowest risk path to any kind of justice or retribution. As dysfunctional, corrupt, or inefficient as they often are.

I point this out not because libertarians don’t know this, but because as an intellectual movement, we seem to have neglected it. While the greats talked about fraud AFAIK, they did not have shitcoins and the internet to contend with. We do.

Years ago I warned that if crypto failed to regulate its excesses, then the feds would come and do it for us. Bitcoin advocates warned endlessly about the risks of crypto ponzinomic schemes for well over a decade, to no avail.

Well, the US government now has a very clear path to regulate crypto, given the 10’s of billions of dollars wasted and stolen by the likes of FTX and other CEFI. People are pissed off, they want blood. That blood lust is a red carpet for politicians and they are waltzing in. The question is, what regulatory structure will they erect? And which should they - if any? And, will it make any difference, given that fraud is already illegal?

We’ll see if the SEC and these laws have any real weight to them with FTX and Scam Bankman Fraud. If the US government will not prosecute SBF on what looks like very clear fraud, despite being part of their elite. If SBF doesn’t get hard time. Then we will get confirmation that the regulatory and legal systems are totally pay-to-play.

My mentor Ugly Old Goat sure seems to think the whole government is pay-to-play and corrupt to the core, starting with the FBI and the SEC. He actually served a decade in prison for wire fraud after his gold backed financial venture went under with the help of the feds decades ago. So it may very well be the case that all this regulatory talk is doomed to fail anyway.

Nevertheless, this article explores the topic from a good faith perspective, addressing the empirical realities and attempting to establish reasonable moral frameworks, which a functional government that is not entirely doomed should be able to approach.

“Know Your Customer Laws” and Identity Theft

First let’s address the most obvious and insidious form of ‘regulation’ that has been plaguing this industry for a decade - know your customer laws (KYC). Every efficient business in the world is going to want to know its customers, of course, if you don’t know who you work for, you are very unlikely to be able to deliver to them what they want.

That’s not what KYC is about though, it's about telling the government who your customers are. It is about forcing businesses to act as spies on their customers, without any warrants coming from law enforcement or probable cause being established in court.

KYC laws are a clear violation and deviation from the US constitution and nevertheless, they are pervasive. They have been implemented across almost most custodial exchanges, increasingly removing all environments for trade that do not require users to dox themselves to exchanges and thus, the government.

What is a "dox" you ask? According to the internet:

“Dox is a term used to describe the malicious release of private information, such as a person's name, address, phone number, or financial information. It is typically done without the victim's consent, with the malicious intent of humiliating or damaging their reputation. Doxing can be done through various means, including searching public databases, using social media, or obtaining information through criminal means.“

While KYC compliance can be considered opt-in, given that no one is being forced to trade shitcoins or buy Bitcoin for that matter. It is funny how this fence of surveillance has been erected around the asset class that many consider an escape hatch from the sinking ship of fiat currency. What is the goal of this surveillance grid?

The expressed goal is to stop “money laundering” the act of concealing the origin and or destination of money that comes from illicit activities. In other words, in order to try and catch criminals *after* they have committed various crimes, globalist regulatory bodies like FATF want to force everyone - billions of people - to send pictures of their passports to financial institutions. Exposing innocent people to the risk of identity theft.

Who cares about these KYC pics you ask? Well criminals care, actually, especially organized crime that focuses on identity theft. See the stupidly frustrating consequences of KYC laws are gigantic hacks resulting in mass doxing of innocent people - people who are just trying to save for their future and their family’s.

"According to statistics from Surfshark, the United States experiences the most data breaches of any country. In 2021, 212.4 million users were affected (compared to 174.4 million in 2020). In second place was Iran, with 156.1 million breached users in 2021 (up from 1.4 million in 2020)."

The result of this regulatory pressure to centralize and distribute KYC data is - I’m convinced - a major source of identity theft, one of the biggest forms of theft in the world, and it results from the digitization of legacy finance.

You see, the financial system was built on verifying access to accounts and credit via analog ID authentication processes such as asking for your name, social security number, address, phone number etc. They are thus regulated as such.

Credit cards work this way as well. Broadcasting the information you need to make payments through various internet networks, creating many points of possible exploitation and fraud. This may have worked in an era where records were kept in paper, at physical banks with serious security, But in the digital age? It's hard to imagine a worse way to do finance.

These processes are far inferior to those used in Bitcoin. Every time you show your ID to your bank teller, you are essentially showing them the password to your bank account.

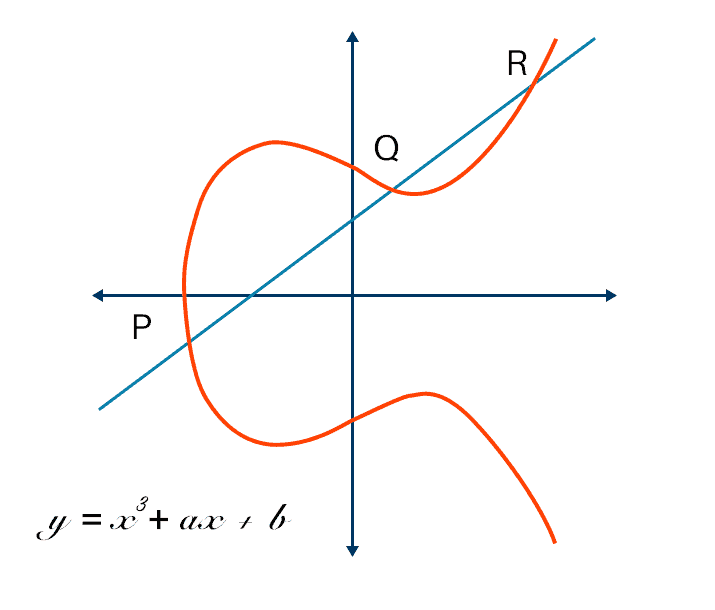

But the cryptographic technologies popularized by Bitcoin solve this with elegance.

By signing a cryptographic contract -so to speak- with your private key, the 12-word seed and its derivative secret stored on your device, you are providing undeniable consent of your will to transact.

The authenticity of the private key can be verified by third parties using the public key associated with your BTC balance as it is itself derived from your private key.

This way, anyone can authenticate your ownership of the bitcoins on that public address or transferred from it, without needing to know anything else about you, be it your name, race, age, gender or nationality.

Is there anything more American than that?

Instead of embracing this technology, however, Senators like Elizabeth Warren want to force surveillance of all financial transactions by anyone they can catch with this umbrella, the whole world ideally. Meanwhile, they are trying to hire tens of thousands of IRS agents to go after your 600-dollar plus payments. As if they couldn't just print more money to fund their pet projects, as they usually do.

The result is tens of billions of dollars in identity theft in the USA alone, every year.

In 2021 total identity fraud impact, by combining traditional identity fraud and identity fraud scam statistics, resulted in $52 billion of loss affecting 42 million U.S. consumer victims

That is like an FTX blowing every year worth of losses to the US economy alone.

KYC-less authentication of financial balances as demonstrated by Bitocin can reach much further than the banking system and provide financial opportunity and access to people with little more than cheap mobile phones. Really lifting up minorities and the poor, which progressives like Senator Elizabeth Warren claim to care so much about it.

But what does she do instead? Propose a bill that would force all crypto wallets to demand KYC information from their users and authenticate it against databases. Likely resulting in more people leaving their coins in the hands of exchanges like FTX, as the benefits of private wallets would drastically diminish and many wallets would go offshore or simply close shop. Warren’s timing, in the shadow of the FTX blow-up, is really absurd.

The bill she is proposing is far worse than just KYC wallets, it is truly draconian, demanding licensing for Bitcoin and crypto open-source developers. Thank God it is unlikely to pass, as 99% of her bills have failed.

However, it is legislative attacks like these that we need to be aware of. While many in Bitcoin believe that political action is futile or against the cypherpunk ethos, I have to strongly disagree.

The early cypherpunks were political activists, yes they wrote code rather than become politicians, but when push came to shove, they took political action by traveling across the pond with cryptographic algorithms printed on their t-shirts and changed law as a result. These are political acts.

Today, we need to support Bitcoin and crypto defense DC groups like Coincenter who, even though they may be crypto agnostic, stand in defense of the cypherpunk principles and clear benefits of these technologies. Defending it ignorant or malicious political attacks like those from Elizabeth Warren.

Finally, It must be said that KYC is not about money laundering, as the vast majority of money laundering is done in dollars, through major banks, by the dark money pools of the intelligence agencies and the military-industrial complex.

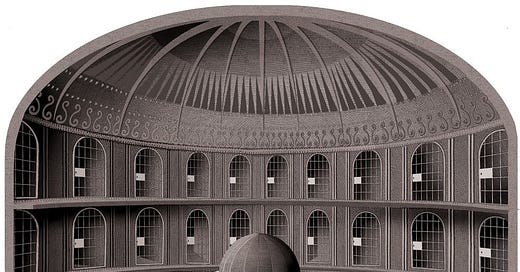

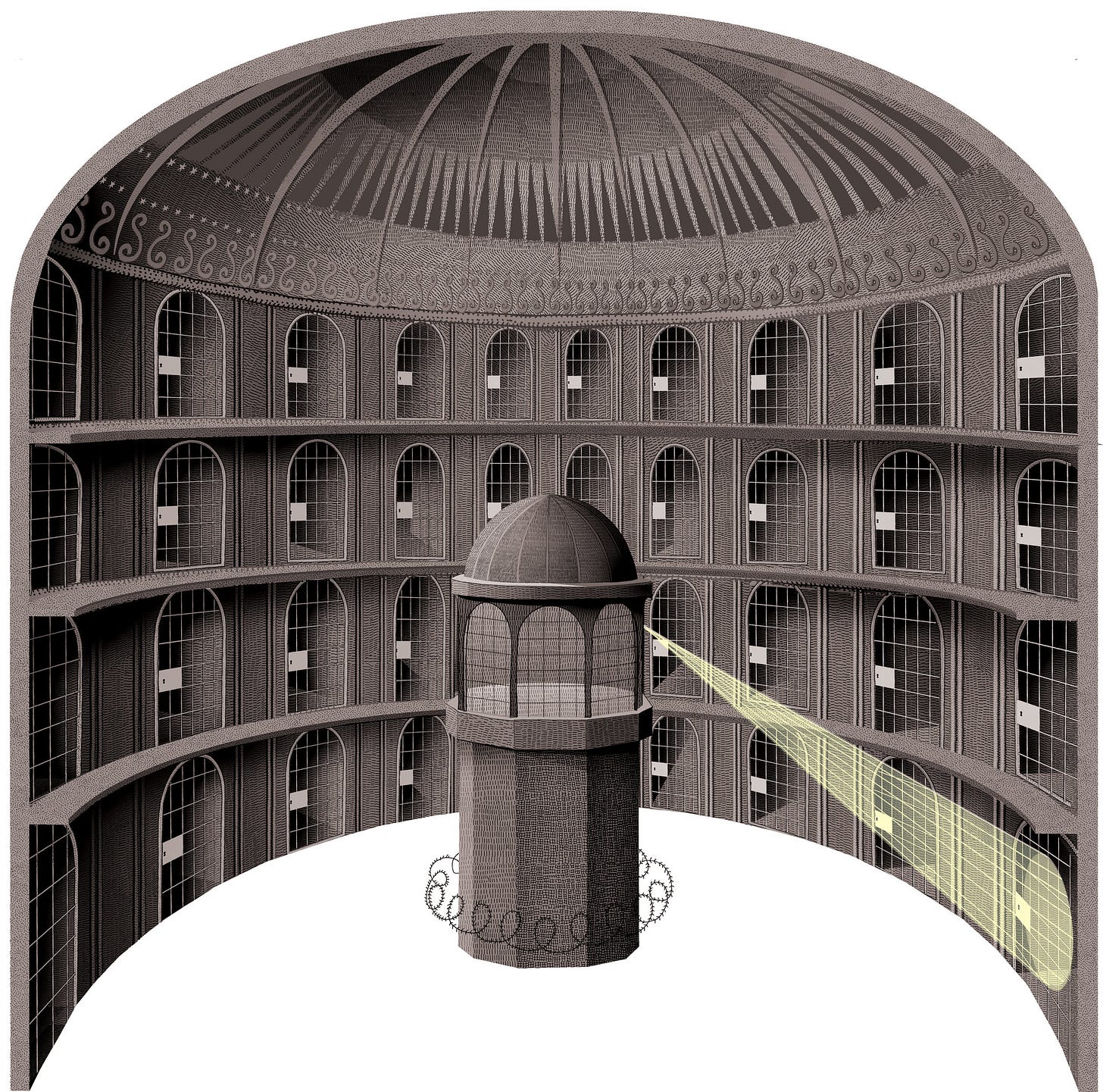

That’s where the real money laundering happens. That AML is their biggest concern about Bitcoin is ridiculous. What they want is for the plebs, you and me - to not escape their financial panopticon. The open-air prison of surveillance and technocratic manipulation that they so salivate to raise around our every move.

Power tends to corrupt and absolute power tends to corrupt absolutely. Elizabeth Warren should be more worried about the money laundering happening via FTX, Ukraine, the military-industrial complex, and her own political party, than innocent civilians trying to escape the financial calamities of the socialism her party continues to push.

Finally, I'll mention that technological solutions to the identity theft problem are being explored. Some with far more dystopian designs than others. It may be that this is the only real path to solving this massive problem, aside from regulatory reform of KYC requirements. But that is certainly a topic for another time.

That's it for now. I was going to publish the whole article in one go, but it was over 5000 words and the editing process is overwhelming. Best break it up in two parts.

Expect part 2 soon. Cheers!

Juan Galt.