Banks Are Dinosaurs

Software is eating the world, banks and their business models included.

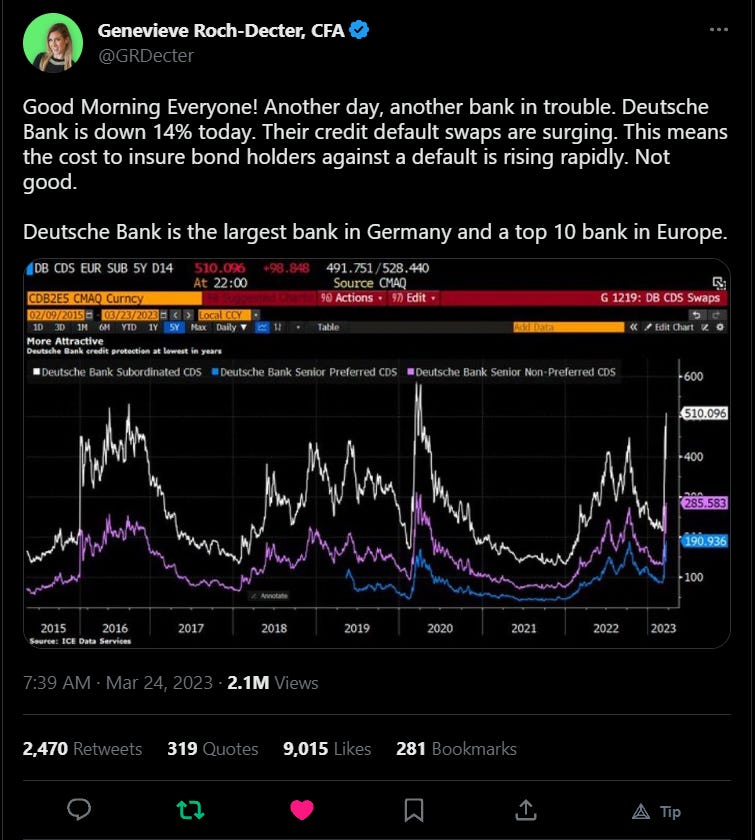

Wow, what a month it’s been. Bank runs all over the US. The biggest German bank wobbling. The FED taking on solvency risk for National and international banks. A lot has happened and it’s hardly summer yet!

Today’s topic is banks and why they are dinosaurs. Many Bitcoiner would like to think that BTC is the meteor in this case, but not quite. The meteor is the digital age.

First, let’s do a little recap of banks and crypto custodial exchanges or otherwise bank-like services that collapsed in recent months.

Celsius - $1.2 billion - uninsured

Blockfi - $1-$10 Billion - uninsured

UST stablecoin - $18 Billion market cap before the flash crash - REKT

FTX - $9 Billion rough estimates - RIP

Silvergate - $13 Billion at ATH Q3 2022 - FDIC insured

Silicon Valley Bank - $200 billion - FDIC full bailout

First Republic - $200 billion - wobbling but standing

Signature Bank - $90 billion - suspicious shut down by NY regulators

Credit Swiss - $530 billion by the end of 2022 - wobbling - bailed out so far

Deutsche Bank - $1.4 trillion - wobbling but still standing…

In total, crypto-related custodians and other shitcoins lost as much as $38.2 billion for customers and depositors. While the tradfi could have lost depositors up to $1 trillion USD had regulators and Federal banks not stepped in.

Spooky numbers ey.

Bank Runs At The Speed Of Light

There’s something all of these bank-like services had in common. The same thing that all banks have in common in the modern age of fractional reserve banking. They use customer funds to invest and make a profit. This practice and business model limits their available reserves, exposing them to bank run risk.

This model might have worked in the age of paper and bank tellers. But alas, that age is long gone. Like many things today, banks are being digitized. Like electricity and gasoline engines did to the age of wooden stoves and horse and buggies. Silicon is eating the world. And so, the threat model to a bank’s balance sheet in the age of Twitter is much bigger than that of the 1930s.

This fact is best illustrated by the speed of the bank run of Silicon Valley Bank, breaking historical records at $40 billion withdrawn within a day. A fifth of the bank’s alleged balance sheet disappeared.

“Customers withdrew $40bn – one-fifth of SVB’s deposits – in just a few hours.”

Consider what that means. It means that given bad enough rumors and influential enough FUD, pretty much any bank could be in very serious trouble overnight. In the digital age rumors are not the only things that fly at the speed of light, bank deposits do as well. Slushing through the fastest payment rails available, Silicon Valley Bank was emptied of its reserves in hours, moving through the US banking system, searching for safety.

But there is no safety, not really. Not unless you are willing to bank with the FED.

And that’s exactly where all of this is going. The FEDNOW system being rolled out in the US right now is touted as a 24/7 365 instant payments system for civilians, businesses, and banks alike. If $40 billion can move overnight out of a bank today, how fast will they be able to move in a year or two?

The FDIC doesn’t have the bullets.

There are something like 8 Trillion dollars of uninsured deposits in US banks. Even if they were ‘insured’ what does that even mean? the FDIC doesn’t even have a trillion USD in its reserves for a bank run. The FED had to step in to help them rescue the US banking system and quell the panic in the market this month.

So the banks have a flank wide open and in my opinion, the FED is positioning for a pincer attack.

The Ultimate Counterparty

The FED’s solution to this crisis was brilliant in a disturbing way.

They took on the bank-run risk off of banks by allowing them to pledge their troubled investments as collateral. Specifically, long-term US bonds issued at near 0% interest rates which they bought before the FED decided to aggressively raise rates. The FED lends them the full face value of these bonds, rather than the spot price which was trading at double-digit discounts, resulting in billions of dollars in temporary losses for banks. This emergency liquidity comes at much higher interest rates of course. So banks are just pushing the can down the road.

All of this was done through the FED’s new facility known as the Bank Term Funding Program (BTFP).

While BTFP dampened the panic in the markets by reassuring depositors, it also further eats into the profit margins of banks. The result appears to be even further risk intolerance for banks, which means their willingness to offer credit and take risk of default on loans and credit cards will continue to decrease.

Banks hardly offer any returns to depositors as is. With FEDNOW being rolled out, what is the point of having a bank at all?

Eventually, there’ll hardly be a reason to use a bank at all, beyond branding and user interfaces perhaps. The FED could even open up an API to software developers, so that a boom in banking apps emerges, completely destroying the custody and transactional aspects of the banking model. Since you might as well just bank with a counterparty that can’t go bankrupt because they print all the money anyway, the FED.

I don’t like this future. I don’t want the FED as my counterparty, but they already are everyone’s counterparty, regardless. This is the groundwork for CBDCs.

And the primary reason we are in a situation like this is a mismatch of incentives at the core of the banking business model. A model which is now threatened by the speed of the digital age.

The Bank’s Business Model Is Broken

The mismatch is simple when seen. Depositors go to banks not to get returns on their savings, that age is long gone. Instead, they are looking for secure storage and ease of transacting, to pay their bills.

Banks, on the other hand, see every deposit as a loan, which they can use to invest and speculate with. These ‘loans’ when above the $250,000 FDIC maximum end up being uninsured and probably uninsurable.

A $250k FDIC-insured maximum means big companies have to take counterparty risk when they put their cash flow in banks. That or start managing their own investment and risk themselves, adding to their overhead. Many of the companies in SVB seemed to be unaware of the risks they were taking.

That illusion of safety has now been shattered.

Another aspect of banking that has drastically changed thanks to the digital age is that of custody. Banks evolved to solve the limitations of gold. You had a shiny rock but, you could be easily shaken down by some highwaymen. So what do you do? put it in that big vault in town, pay some kind of fee, and authenticate with your face. Also, paying for milk and eggs with gold is kinda difficult. Not trivial to divide this rare metal. So paper cash IOUs emerged as the solution, originally backed by gold in banks.

Well, in the digital age of fiat money, the need for all this infrastructure becomes less obvious.

If money no longer has to be backed by anything but the faith and credit of your local government -as the fiat world suggests- then you don’t even need a vault. There’s nothing to secure anyway! It’s all just a balance sheet. The collateral to your money are tanks and politicians. lol.

The advent of cryptographic money has also dematerialized vaults. If something like USDC or Tether was integrated into the financial system for example, custody could be solved by non-custodial wallets, allowing users to authenticate into the FED’s balance sheet using 12 magic words and some private keys, rather than face authentication by a bank teller.

Software is eating the world.

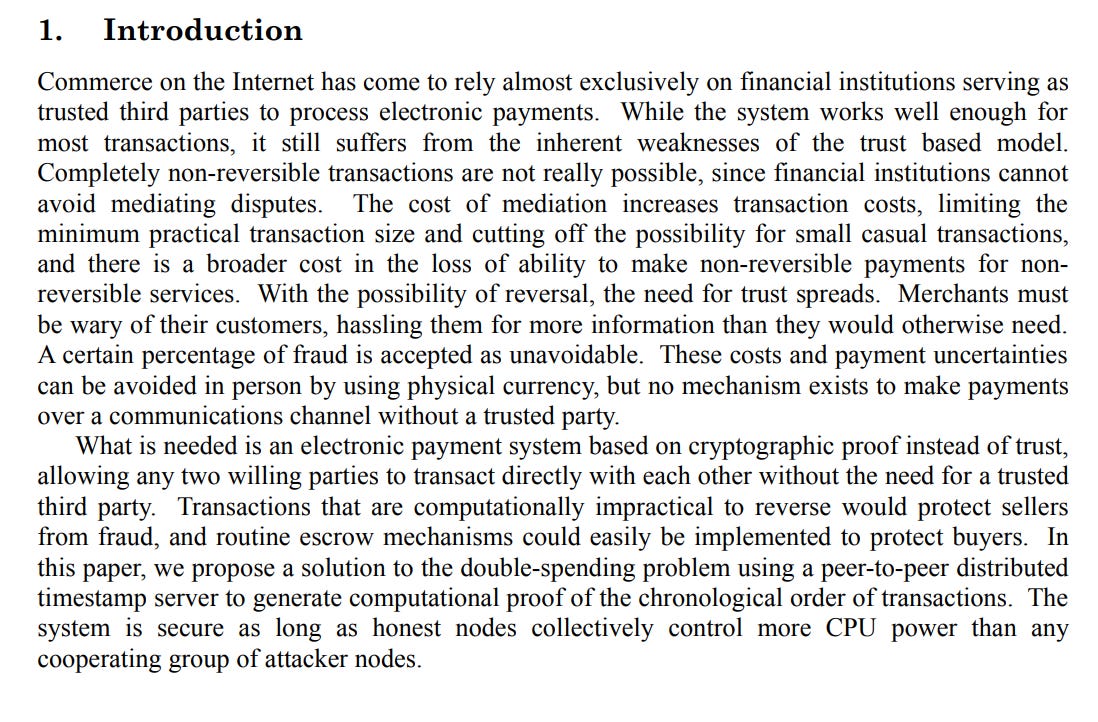

Bank heists are no longer done with guns and face masks. But by falsifying the authentication methods to bank’s balance sheets, in what’s known as identity theft. Another issue that cryptographic, privacy-preserving money like Bitcoin solves.

You don’t even need a blockchain when you are issuing digital fiat. The FED could release a pseudonymous digital cash system like any of the stablecoin out there and take over the market if they were not so hell-bent on knowing what you and your grandma do with your coins. They of course don’t want cash, they want full control, but that’s beside the point.

The bottom line is, the FED is getting into the banking business, eventually, they will be the only counterparty people will need to deal with, and with the power to print money you’ll be ‘safer’ than with any bank. Of course, inflation will continue to be an issue, but that’s an entirely different problem.

Bank tellers are already increasingly digitized, AI will take customer service everywhere to a whole new level, further dematerializing the world.

Let’s talk about fraud a little more because this problem fascinates me.

Authentication and Fraud Security

There’s one more problem for banks, and this one is huge.

I’ve written about it before but no one seems to care, lol. It is identity theft and fraud. Bank in the day, before computers and so on, to prove who you were to a bank, you’d show up with your face and your ID.

A bank teller would do a facial recognition authentication of you against your ID and their records, and if you passed you’d get access to your bank account. That was secure enough for most things since it was kinda hard to fake a face. There were other checks in place too, but this was the primary one.

Well, not only do we live in the age of social media, where everyone’s face is publicly available from multiple angles. But artificial intelligence is shredding such security at alarming speeds. It is now trivial for any script kiddy to use a picture or two from anyone to generate a realistic video of you, using what is known as deep fakes.

As banks become further digitized, deep fakes will become an open attack vector.

They already are.

Even people’s voices can be faked quite effectively, destroying a recently popularized authentication technology for banking apps around a user’s voice.

To top it off, regulators can’t get enough of your data. They’ve forced every financial service of any sort to ask you for KYC selfies, which include most of what you need to authenticate into a bank account into one simple picture. These pictures are sent to someone’s servers and who knows who else gets access to them. Hacks happen regularly at these data counterparties and the identity information ends up in the dark web, being bought up by organized crime who then use it to try to scam anyone they can, with your name.

In 2021 total identity fraud impact, combining traditional identity fraud and identity fraud scam statistics, resulted in $52 billion of loss affecting 42 million U.S. consumer victims

Every time one of these scams succeeds at a bank or any other related service, the banks have to take a loss, trying to manage their balance sheet in a way that at the end of the day, they can cover costs and deposits. They can get insurance against these threats of course, but that further eats into their profit margins and thus your ability to earn a return on your savings.

The solutions are not trivial, but this is one area where Bitcoin has had massive innovation. Using cryptography to authenticate users without the need for private, personal information. Millions of people have managed to access the financial world in a more secure way. Of course, there’s a steep learning curve here and a generational gap, both of which will only be closed with time, education, and improving technology.

But good luck getting regulators to recognize that zero-knowledge financial systems are more secure.

Inflation - Destroyer Of Banks

Cherry on top? Even if you still preferred bank branding on your fiat money app vs something like FEDNOW, inflation will continue to eat your savings. 6% per year means you have to work 6% harder every year, and become 6% more efficient to break even. And that’s the official inflation rate, we all know it’s a lot higher than that.

Have you seen what eggs cost these days??

And that’s in the US alone, many other fiat currencies are doing far, far worse. To protect your savings you have a few options.

But options do exist, just not in banks lol.

So what is the solution?

There are 5 paths that I am aware of, laid forward for people, or sophisticated enough investors anyway. The following is most certainly not investment advice.

Good old fashion cash under the mattress, plus some risk on bets

Go to physical cash and eat the inflation. Keep only what you need for cash flow and payments in the banks. Put the rest under your mattress, reinvest it into your business, or invest it in lowering your ongoing costs. Finally, grab that alleged 6% and yolo some risk on investments that may be double or triple. That might let you break even at least.

Shiny rocks

Buy gold, and eat the entry and exit commissions relevant when you want to make a payment. Since sending rocks over the mail is hardly a payment system. Rocks are pretty useless, especially in the digital age, though at least you have some potential upside as the world divests from fiat banking.

Brokrages and the S&P

Turns out stock brokers have even better insurance and risk management practices than banks! With Interactive Brokers touting up to 2.5 Million in depositor insurance, plus the 250k offered by the FDIC. So there’s a solid argument for yoloing the S&P 500 with money you don’t intend to use or expect to need any time soon.

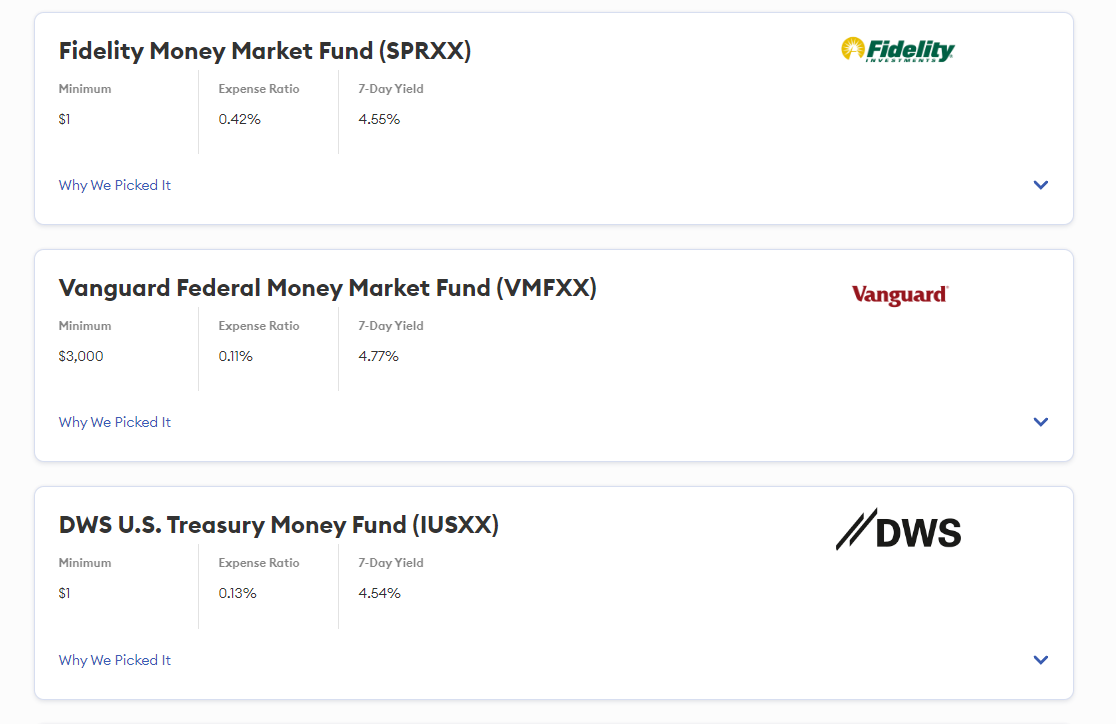

Money Market Funds

Money market funds, are hedge funds of sorts that manage short-term bond portfolios and other cash-like assets, earning reasonable interest rates in today’s age. Can you imagine your bank offering you 4.5% back on a 7-day turnaround? I can’t. There are other risks associated with MMFs but they offer strong cash-out liquidity and you don’t have to micromanage them. Here are some examples.

Bitcoin

You knew it was coming. Bitcoin is a trustless, full reserve bank in cyberspace. Yes, Bitcoin is volatile, more than any of the above options. So there’s downside potential you have to consider, however, the upside is much better than - 6% per year. And while it is a developing market, even 13 years into it’s invention, it never the less has some very interesting properties.

Bitcoin can be held in self-custody, be it a single 12-word phrase that Bitcoin wallets aid you in creating. Or multi-signature wallets which can have access keys distributed across various locations, and which require say 2 of 3 or 3 of 5 keys to authorize a transfer. There is a ton more to be talked about here, and you can expect this newsletter to teach out about it. But the bottom line is, bank-grade security can be achieved by civilians thanks to Bitcoin, with relatively little effort.

Bitcoin’s lightning network is a transactional layer that allows for the asset to move at the speed of light, across the world. Fees are near zero and a whole industry of lightning-powered financial services is growing, in part thanks to the adoption of Bitcoin as a national currency in El Salvador. Like FEDNOW, Bitcoin’s Lightning Network allows 24/7 365 instant payments, but globally. And the ability to denominate the value sent and received in USD and other fiat currencies is already being deployed and developed.

Dollar-cost averaging, a very popular investment strategy in the Bitcoin world, allows buyers to establish a position over time, automagically, by allowing your bank account to make weekly payments of a fixed amount to services like Swan, who buy BTC with your deposits and send the Bitcoin to your cold storage wallet. The result is that on a downturn, your average buy price is continuously lowered, resulting in powerful positions when the bull market returns. For example, if you had DCA’d into Bitcoin starting at the all-time high of $69,000 USD, today you would be over 8% in profit. And that’s the worst-case scenario after a 60% correction form the ATH til now.

Wild right? it’s a whole new way of saving, with zero counterparty risk.

The best company in the US for dollar cost averaging into Bitcoin is without a doubt Swan, which automates everything and withdraws to your cold storage, check it out. There are others, depending on where you live.

Finally, Bitcoin’s scarce supply and resistance to monetary policy changes make it a very interesting financial product, which tends to go up in times of massive money printing, in correlation with the S&P but also seems to react well to a banking crisis as we’ve seen recently and in events like the Cyprus bail-in. It also reacts well to currency crises as seen in Argentina, Venezuela, and other nations with hyperinflating currencies.

If you want to learn Bitcoin's best practices, how to secure it, and use it like a Samurai. Subscribe to my newsletter. A series of premium articles on Bitcoin security that are easy to use, as well as how to surf the waves of the markets are incoming. And by signing up for emails, you’ll be the first to know.